wa state long term care payroll tax opt out

In order for the Washington state to allow you an exception to payment of the payroll tax and allow you to opt out of the States Long Term Care plan you will need to show them information about your private policy that is in force prior to your opt out request. Basics of the WA Cares Tax.

Here S What To Know About Washington State S New Long Term Care Tax

You need to already have or purchase a long-term-care plan through a private insurer by.

. Go to an apply for an exemption button near the bottom of the exemptions page of the WA Cares Fund website. 1 to opt out of the states long-term care program which will help pay for nursing care and other support services for people who can no longer care for. If a WA resident is nearing retirement it is not worth opting out of the long-term care payroll tax.

In that case the tax will be permanent and mandatory. 1 to escape new payroll tax. The payroll tax applies to active W-2 employees only.

1 2022 employers will begin withholding a new payroll tax from employee paychecks as a premium payment for the new long-term care benefit. Click it and follow the directions on. Opt-out option for Washingtons long-term care tax begins Oct.

The State has strict guidelines that private Long Term Care policy must include in order to qualify for the exception. I strongly opposed this new state mandate and I want to make sure Washington. The tax will total 058 percent of your W-2 income with no maximum limit.

Washington residents must enroll in private insurance by Nov. The WA Cares Fund. A bill that moves up the deadline for employees to opt out of the states upcoming long-term services and supports program and its associated payroll taxes is on its way to the Governor.

Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply. Opting back in is not an option provided in current law. The employee must provide proof of their ESD exemption to their employer before the employer can waive.

Washington workers have until Nov. Workers who live out of state and work in Washington military spouses workers on non-immigrant visas and certain veterans with disabilities will be able to opt out of the program if they choose. But if you want to opt out you may have some.

The initial premium rate 058. Individuals who have private long-term care insurance may opt-out. For now those who have private LTCI can apply to opt out of the state program and payroll tax by following the steps below.

AWC partnered with other organizations and employers to successfully push back the opt-out date to November 1 2021 to allow employees more time to consider their long-term. To be allowed to opt out from the long-term-care payroll tax in Washington state does the long-term care insurance have to be active by November 1 2021 or simply be purchased by November 1 2021. If a WA resident earns less than 100000 a year or does not plan to earn more than 100000 a year in their career it is not worth opting out of the long-term care payroll tax.

The most significant legislative change is additional time for employees to opt out of the public program. The new mandate burdens family budgets makes false promises and takes away choices. Any employee who attests that they have comparable long-term care insurance purchased before November 1 2021 may apply to ESD for an exemption from the premium assessment.

An employee tax for Washingtons new long-term care benefits starts in January. October 31 2021 at 924 pm PDT By KIRO 7 News Staff. Capped lifetime benefit at 36500 the benefits would pay out a max of 100 a day for up to 365 days.

Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. If the latter what counts as the purchase date. Employers will refund any premiums collected in 2022 so far.

This is also true if you move to Washington state after the opt out window closes after 12312022 and you didnt already own long-term care insurance with a policy date. This new fund was created by the State Legislature to. Monday is the deadline to have your private long-term care insurance plan in place in.

Review this guide to the current WA Cares exemptions and learn how to opt-out if you qualify. The date has arrived. Workers will begin contributing to the fund in July 2023.

If you want to opt out of a payroll tax that begins in January assessed to fund a state-run one-size-fits-all long-term-care-insurance fund that you might or might not benefit from read more about the coming tax on our Center for Health Care blog here is what we know. State-run long-term care insurance program in 2019. Washington workers will pay a.

Dear friends and neighbors A new payroll tax for a state long-term care insurance program will soon go into effect the result of legislation approved by the Legislatures majority party. Summary of the Washington State Long Term Care Trust Act. This alert summarizes the current state of the law resulting from final amendments adopted by the.

Washington States Long-Term Care Trust Act will provide long-term care services to those who pay into the program and need assistance with daily activities. The State of Washington has now opened their online opt-out procedure for those who have qualifying Long-Term Care Insurance and wish to be exempt from the upcoming payroll tax. 3 out of 6 Actives of Daily Living ADLs trigger.

State residents can apply for benefits after paying the WA Cares tax. Recent changes to Washington State law will require employees to acquire long-term care insurance by November 1 2021 to avoid additional payroll taxes. Before we outline the process lets review some details about the new WA Cares Fund.

1 2023 exemptions granted to military spouses non-immigrant visa holders and those living outside Washington will not be permanent. The opt out also applies to some disabled veterans military spouses and non-immigrant temporary workers. Already more than 470000 Washingtonians representing more than a third of the states payroll have requested to opt out of the program after.

For example employees who earn a 125000 annual salary will pay 725 toward WA Cares in 2022. Starting January 1st 2022 the state will impose a 058 payroll tax on all W-2 employees who reside in Washington.

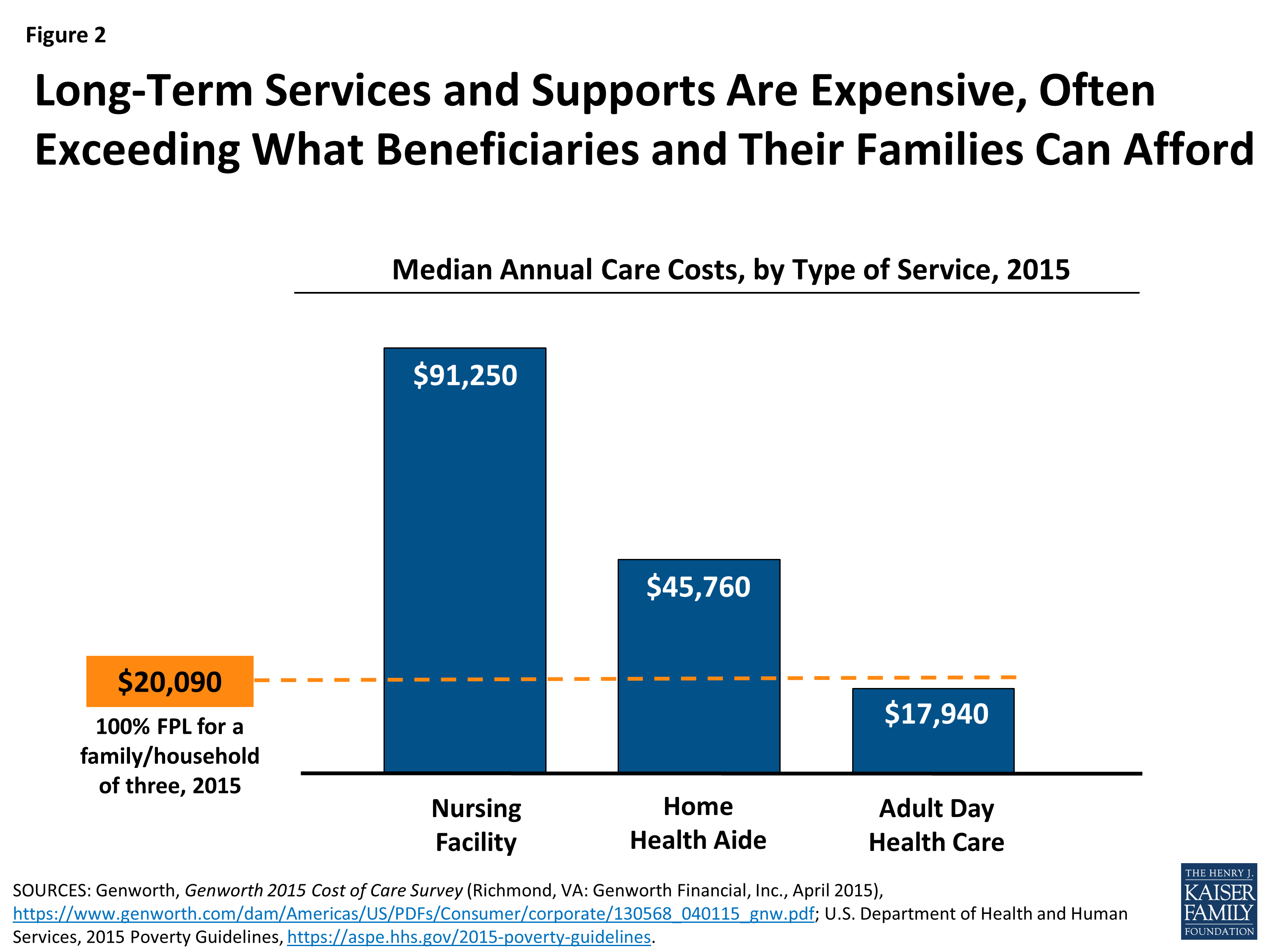

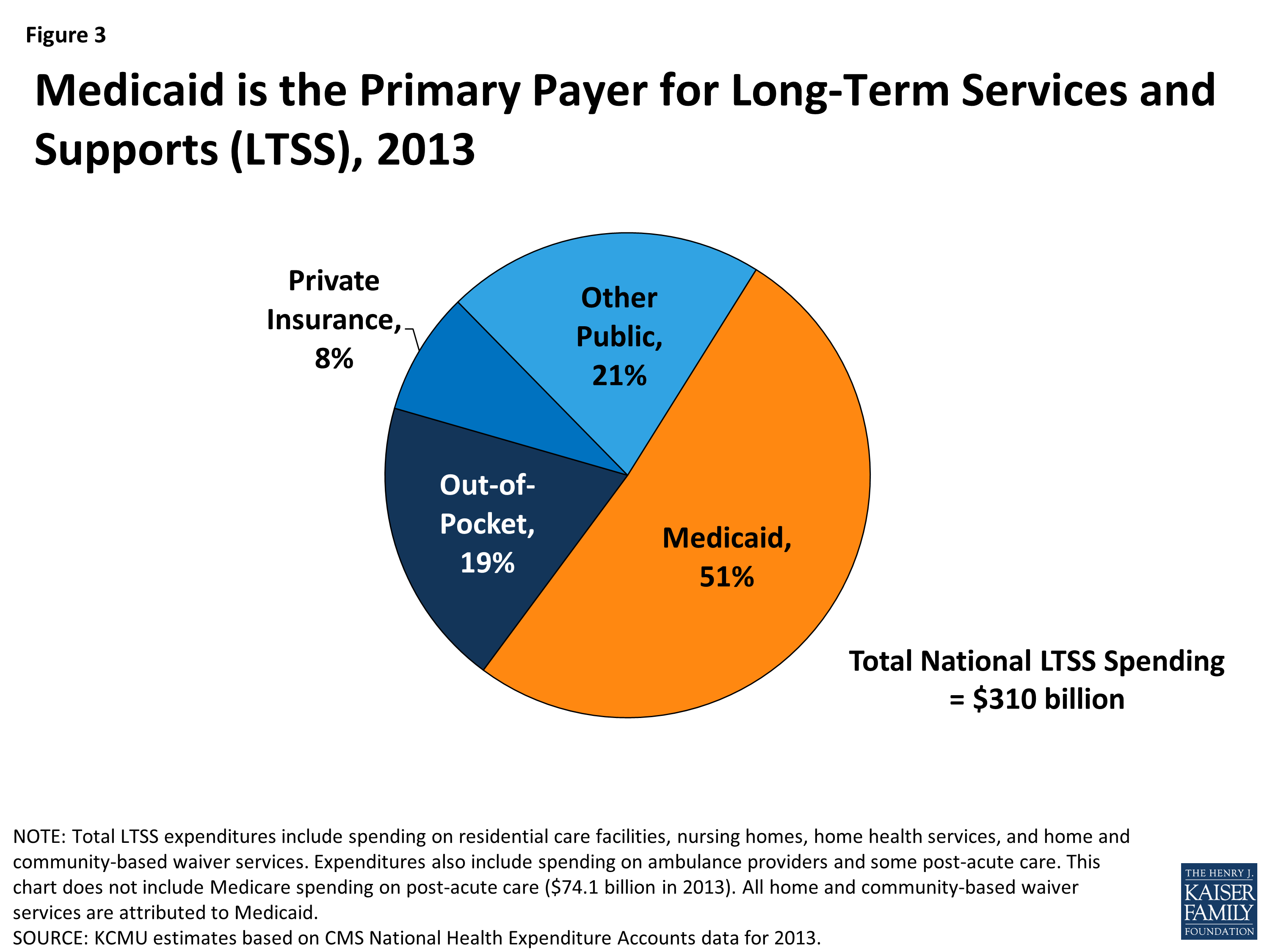

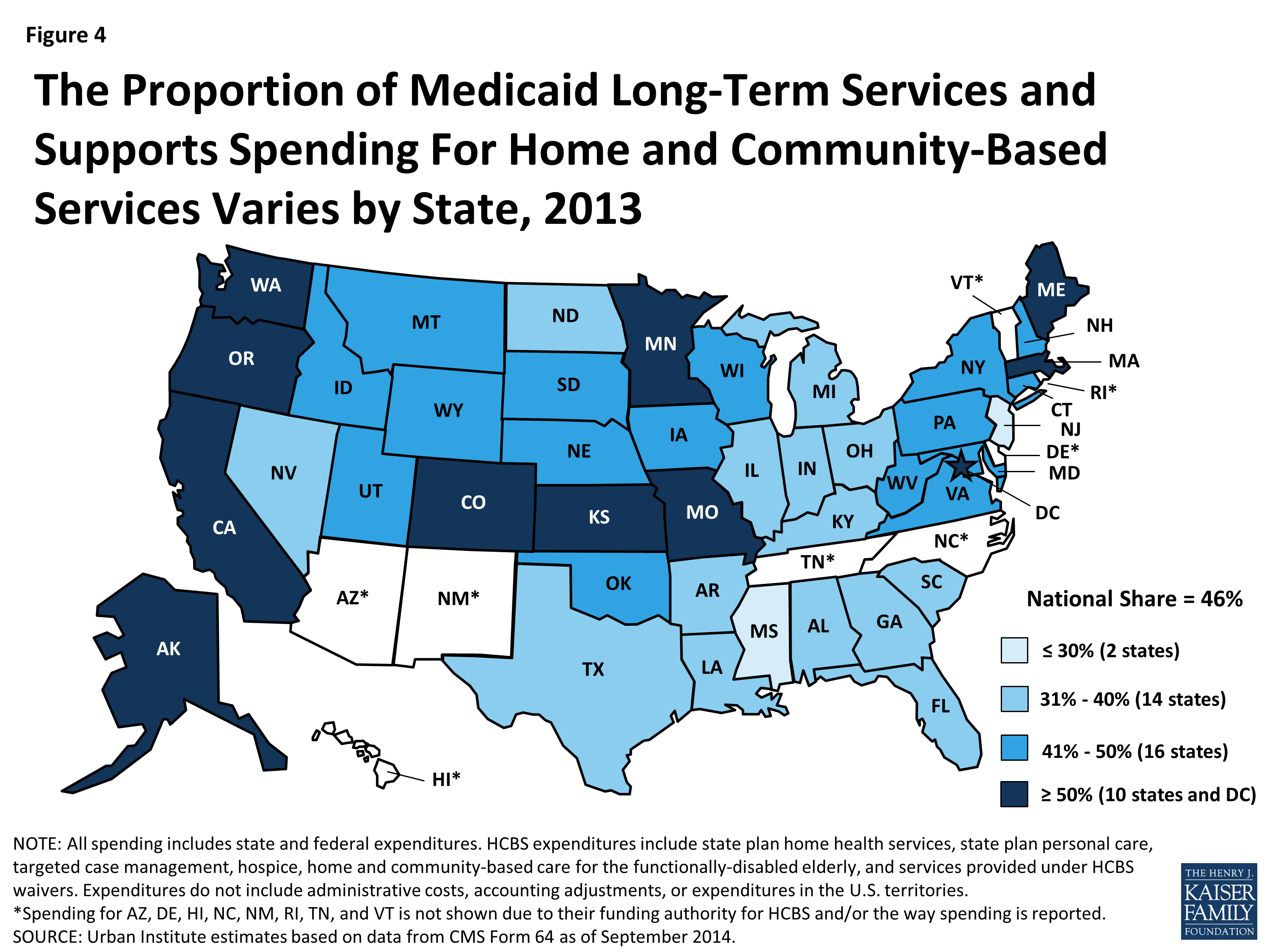

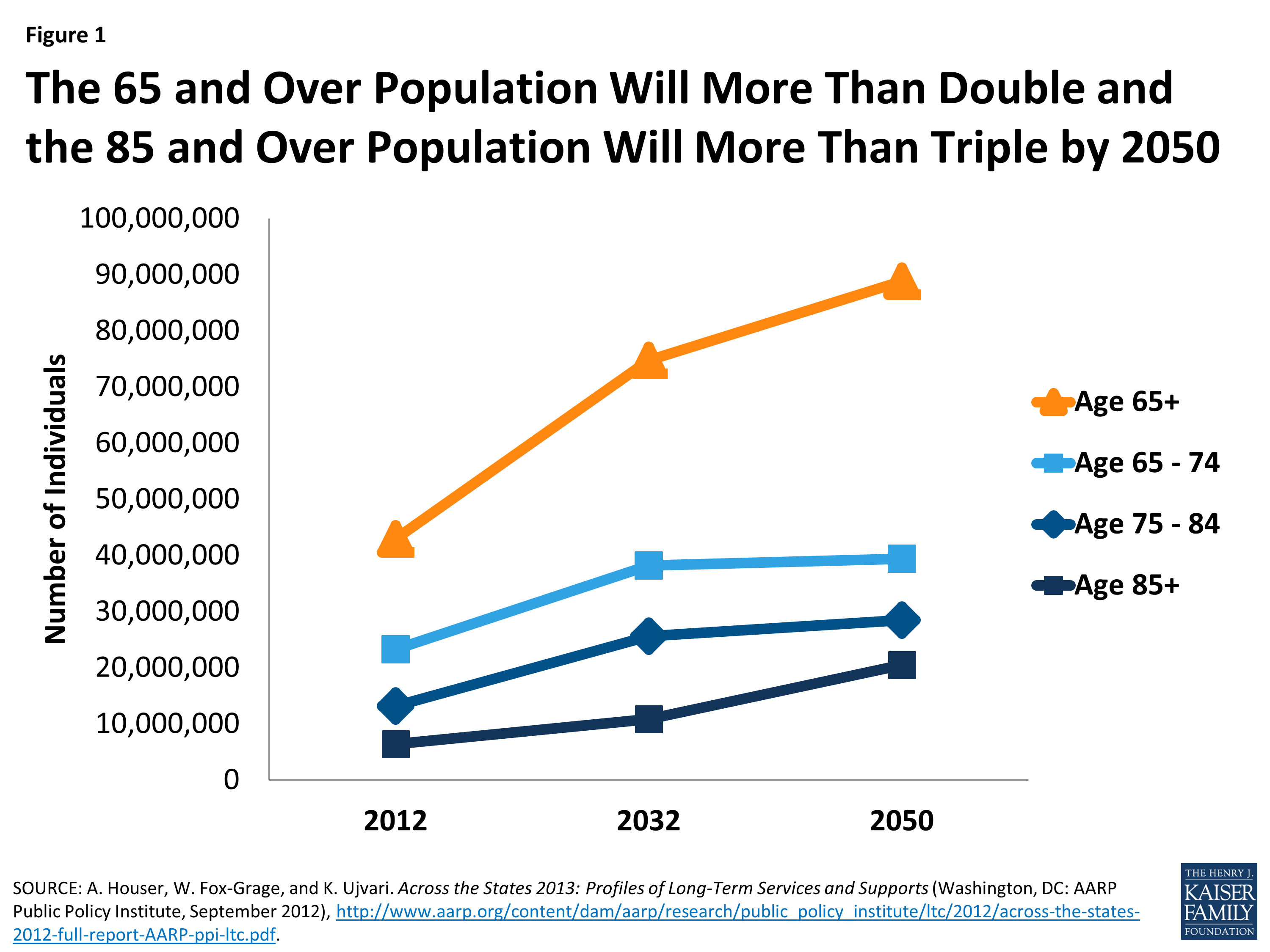

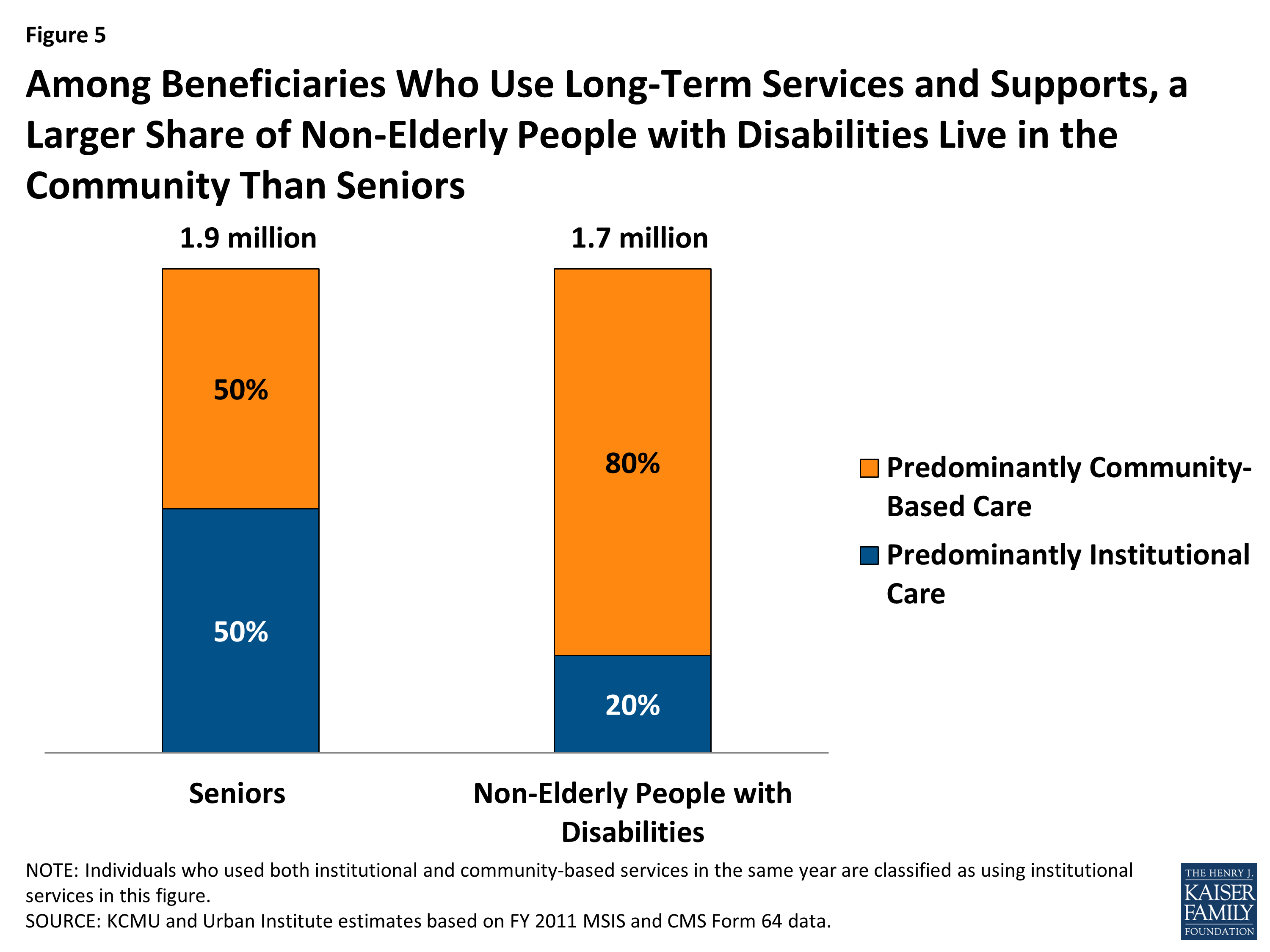

Medicaid And Long Term Services And Supports A Primer Report 8617 02 Update Kff

Commentary Long Term Care Program Needs More Than A Short Term Delay The Daily Chronicle

I 1436 Will Give Workers Choices On State S Long Term Care Insurance Program In 2021 Long Term Care Insurance Long Term Care Medical Insurance

Is Long Term Care Insurance Worth It Mason Finance

Why To Consider Opting Out Of Washington State S Long Term Care Trust Act King5 Com

The Wa Cares Exemption Application Doesn T Ask For Any Evidence Of Insurance R Seattlewa

Washington State S New Long Term Care Statute Is A Mess Can Erisa Preemption Provide The Cleanup Employment Advisor Davis Wright Tremaine

Medicaid And Long Term Services And Supports A Primer Report 8617 02 Update Kff

Medicaid And Long Term Services And Supports A Primer Report 8617 02 Update Kff

Medicaid And Long Term Services And Supports A Primer Report 8617 02 Update Kff

I 1436 Will Give Workers Choices On State S Long Term Care Insurance Program In 2021 Long Term Care Insurance Long Term Care Medical Insurance

Hb 1323 Disregards Original Intent Of Long Term Care Trust Act At The Expense Of Wa Residents Association Of Washington Business

.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary).jpg)

The Private Ltc Insurance Option For Washington State Workers

Medicaid And Long Term Services And Supports A Primer Report 8617 02 Update Kff

Here S What To Know About Washington State S New Long Term Care Tax

Commentary Long Term Care Program Needs More Than A Short Term Delay The Daily Chronicle

The State Of Long Term Care Insurance In Washington A 5 Minute Review Ibekwe Insurance

Washington Gov Jay Inslee Pauses Long Term Care Payroll As Start Date Approaches Puget Sound Business Journal